Optimized Decisioning Proven to Reduce Warehouse Expense

OptiFunder’s optimized decisioning achieved the lowest cost of capital, reducing funding expense by 15.8%. Streamlining with automation increases the savings. It's a proven way for originators to reduce costs.

Client Experienced Significant Savings

Reduced Funding Expense

Reduced funding expense by an average of 15.8%

Drastic Monthly Savings

Optimization savings of $480,000 a month.

Optimized Decisioning Reduces Warehouse Expense by 15.8%

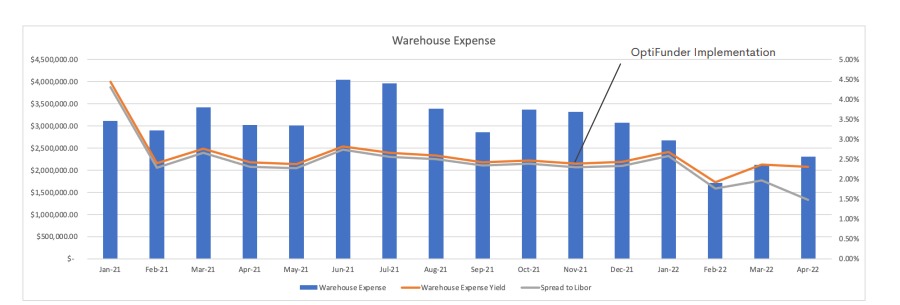

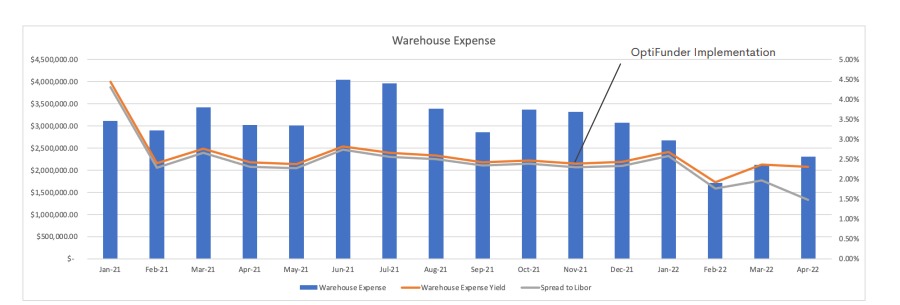

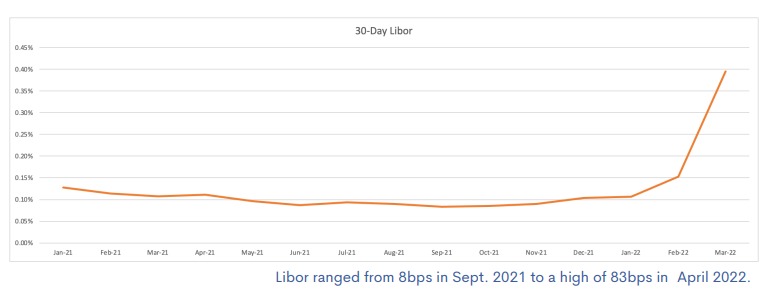

This pre/post OptiFunder study was informed by loan-level warehouse expense data provided by the client for the period of January 2021 to April 2022. It includes interest expense, fees, non-use fees and rebates. The client began using OptiFunder's optimized decision engine November 3, 2021. The pre-OptiFunder period is defined as January 2021 through October 2021 and the post-OptiFunder period is defined as November 2021 through April 2022. The thirty-day LIBOR was used as the reference rate for the analysis.

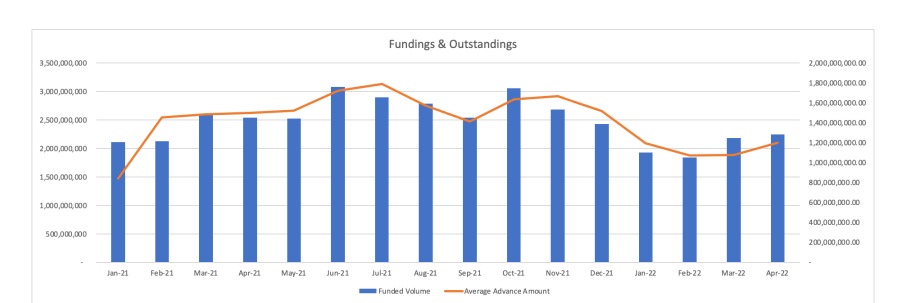

The Client is a leading national independent mortgage banker with average monthly fundings of $2.5bn during the study period.

Achieved Lowest Cost of Capital for National Independent Mortgage Banker

- Total Study Period: $1.45bn

- Pre-OptiFunder: $1.49bn

- Post-OptiFunder implementation: $1.29bn

- Total Study Period: $2.5bn

- Pre-OptiFunder: $2.6bn

- After OptiFunder Implementation: $2.2bn

Warehouse Expense & Spread

- Pre-OptiFunder average spread to LIBOR: 2.47%

- Post-OptiFunder average spread to LIBOR: 2.08%

- Estimating average outstanding balance of $1.45bn, the decline in spread equates to $481,561 in monthly warehouse savings.

- Estimated annualized savings of $5.8mm to the originator's bottom line.

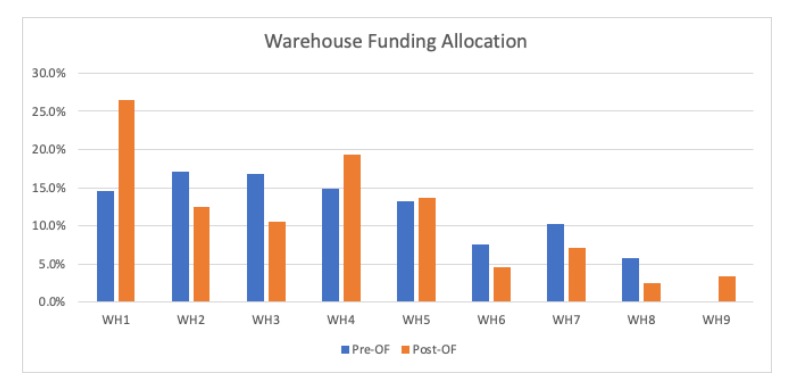

Warehouse Utilization

Throughout the study period, the client utilized nine warehouse facilities. The specific warehouse lenders utilized, and the overall number of warehouse facilities did not change throughout the study period, nor did the terms of the warehouse agreements. The share of loans funded with each lender did vary pre/post-OptiFunder implementation. The OptiFunder Select decision engine makes dynamic decisions, adapting to pipeline, facility and market factors.

The study results show significant savings.

OptiFunder’s optimized decisioning achieved the lowest cost of capital, reducing funding expense by 15.8%. Streamlining with automation increases the savings. It's a proven way for originators to reduce costs.