Optimized Decisioning Proven to Reduce Warehouse Expense

OptiFunder’s optimized decision engine achieved the strategic objective of lowest cost of capital, reducing funding expense by 9.8%, and is a proven way for originators to reduce costs.

Client Experienced Significant Savings

Reduced Funding Expense by $95k/mo

Saved 9.8% of Funding Expense

Annualized Optimization Savings of $1.1mm

Optimized Decisioning Reduces Warehouse Expense by 8-10%

OptiFunder, the industry’s only Warehouse Management System (WMS), combines automation for all funding and loan sale tasks with an optimized warehouse decision engine. Previous studies have shown OptiFunder's optimized decisioning reduces clients' funding expense by an average of 8-10% by using patent-pending algorithms and AI/ML technology to help clients make better informed, dynamic decisions to achieve strategic objectives. We conducted a pre-/post- cost comparison study of one independent mortgage banker, following a successful onboarding.

The study was completed after three months of funding on the platform. Herein, we review the study parameters, results and key takeaways.

Achieved Lowest Cost of Capital for Independent Retail, Mortgage Lender

Loan-level warehouse expense data access was provided by client to OptiFunder covering the periods of January 2021 – February 2022. The data included interest expense, fees, non-use and rebates. Client began using OptiFunder decisions November 3, 2021. The pre-OptiFunder period is defined as January 2021 – October 2021 and the post-OptiFunder period is defined as November 2021 – January 2022. Thirty-day Libor was used as the reference rate for the analysis.

This study doesn't include additional savings achieved via OptiFunder platform automation/FTE resource savings.

The client is an independent mortgage banker with branches nationwide. Average monthly volume funded during the period was $698.6mm, utilizing eight warehouse facilities.

The OptiFunder WMS has a rules-based decision engine which enables originators to optimize decisions to meet strategic objectives such as maximizing ROE, meeting specific funding targets or achieving the lowest cost of capital. For this study, the objective was to achieve the lowest cost of capital.

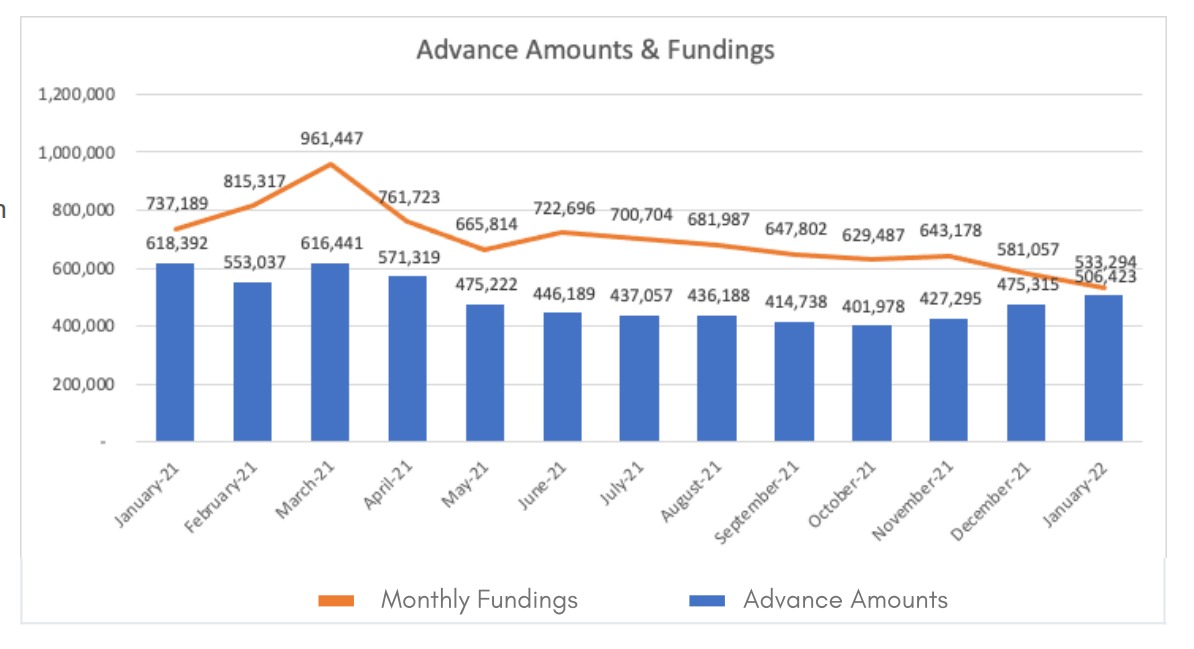

- Total Study Period: $490.7mm

- Pre-OptiFunder: $497 mm

- Post-OptiFunder implementation: $469.7mm

- Total Study Period: $698.6mm

- Pre-OptiFunder: $732.4mm

- Post OptiFunder implementation: $585.8mm

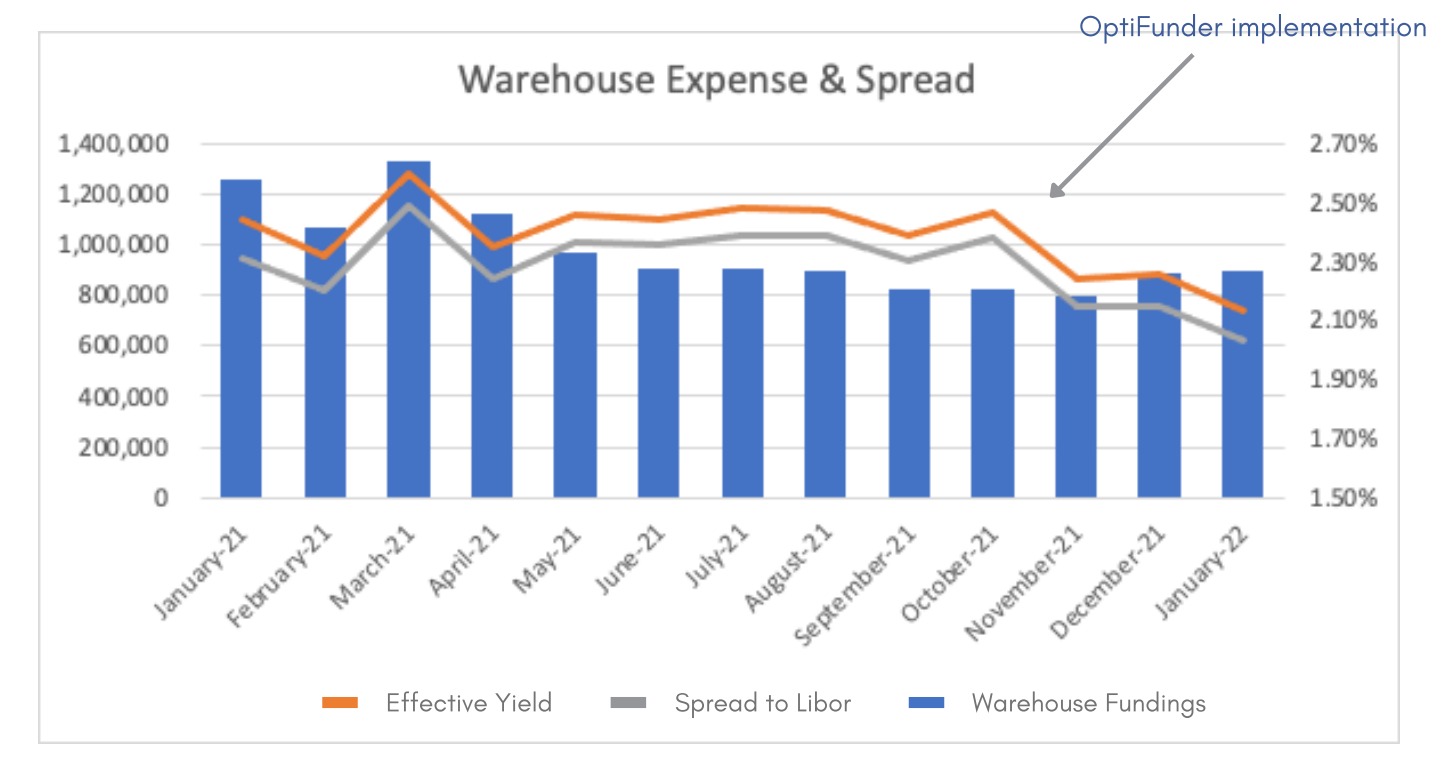

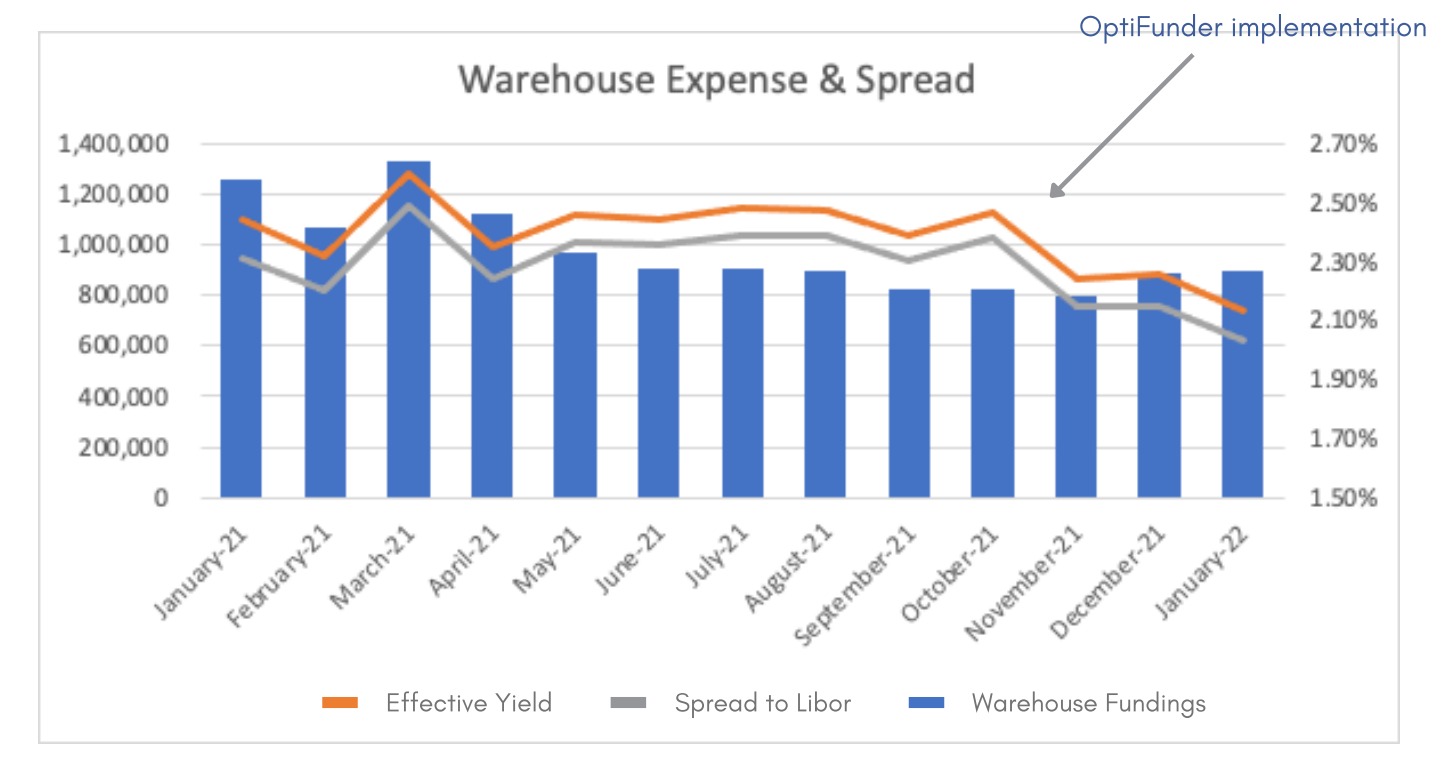

Warehouse Expense & Spread

- Pre-OptiFunder average spread to LIBOR: 2.34%

- Post-OptiFunder average spread to LIBOR: 2.11%

- Estimating average outstanding balance of $491mm, the decline in spread equates to $95,432 in monthly warehouse savings

- Estimated annualized savings of $1.1mm to the IMB's bottom line.

Warehouse Utilization

Throughout the study period, the client utilized eight warehouse facilities. The specific warehouse lenders utilized and the overall number of warehouse facilities did not change throughout the study period, nor did the terms of the warehouse agreements. The share of loans funded with each lender did vary pre/post-OptiFunder implementation. The OptiFunder Select decision engine makes dynamic decisions, adapting to pipeline, facility and market factors.

Warehouse expense for every month funded on the OptiFunder platform was lower than each of the previous 12 months.

OptiFunder’s optimized decision engine achieved the strategic objective of lowest cost of capital, reducing funding expense by 9.8%, and is a proven way for originators to reduce costs.

Similar study findings and reports by other clients, support these results. These savings do not include efficiencies gained with automation of funding and loan sale activities. In a time of declining margins & revenue, optimized decisioning is a way to preserve profits; streamlining with automation improves these savings. In this challenging market, IMBs should embrace a full warehouse management system combining automation of tasks with optimized decisioning to maximize savings.